Revenue Finance

Many businesses find it difficult to access the funds that they need, when they need them. Revenue Finance gives you quick, easy access to funding, putting you in control.

Whether you’re looking to restock, invest in marketing, or respond to new opportunities, give your business a boost with tailor-made funding that flexes with your cash flow.

You could get funds between

You could get your Funds in as little as

Transparent pricing with

With an easy application process and a bespoke quote agreed upfront, our funding offers customers a better, quicker way to support growth.

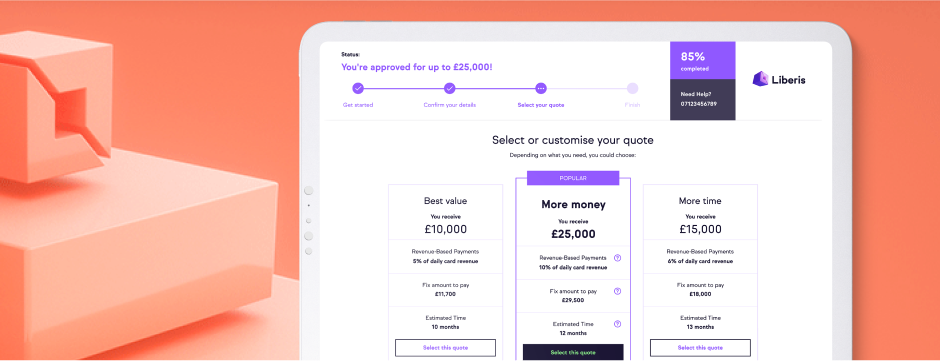

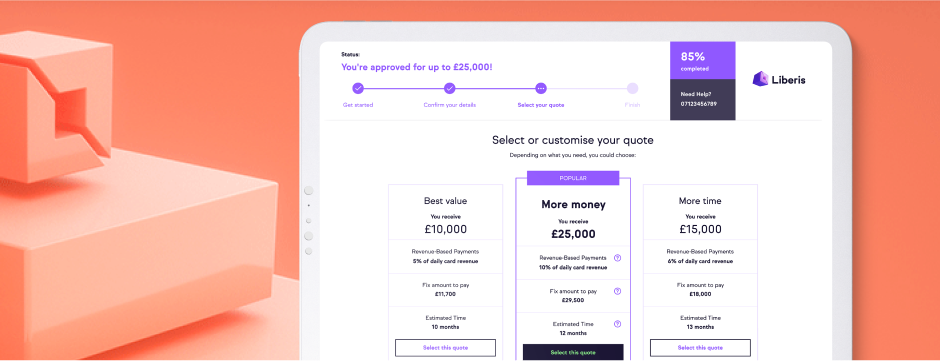

We’ll provide you a selection of personalised quotes that enable you to choose the terms that are right for your business.

Our flexible payment structure works in line with your card takings, so you only pay as customers pay you.

|

|||

Apply for funding in minutes |

Bespoke offers tailored to your business |

Payments made in line with your revenue |

|

| Eligibility |

With an easy application process and a bespoke quote agreed upfront, our funding offers customers a better, quicker way to support growth. |

We’ll provide you a selection of personalised quotes that enable you to choose the terms that are right for your business. |

Our flexible payment structure works in line with your card takings, so you only pay as customers pay you. |

We know there’s good days and slower ones in business. That’s why our flexible payment structure align with your card takings, so you only pay as customers pay you.

Funding calculator

We do business finance a little differently with business owners at the centre.

We’re flexible! So you can pay more when you’re flush and less when you need to tighten the belt.

We already know your business finances inside-out, meaning less admin and minimal stress.

Quick application process. Apply in minutes and get a fuss-free quote and funds in as little as 48 hours².

With a 4.9 on Trustpilot, why shout when our customers do it for us?

We work with you to agree a quote upfront that will flex with your cash flow and your business.

Payments are based on the flow of your business, so you only pay when your customers pay you.