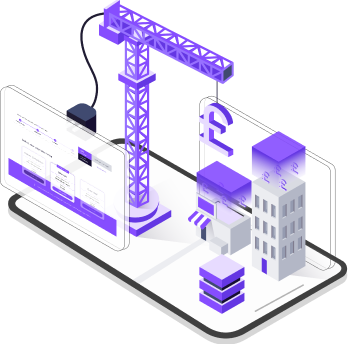

Embedding the Liberis platform into your own customer experience

Integrate using our API

Embed the Liberis platform into your customer experience with a single API integration.

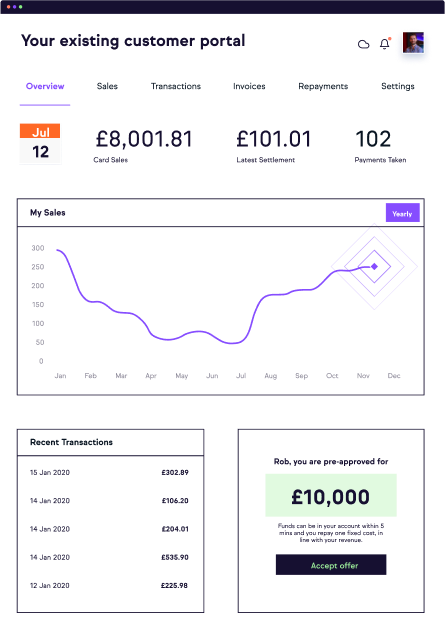

A custom-made build

We build you a custom-made site and journey, powered by Liberis and in your own brand identity.

Visit our developer site